Planning a budget for digital advertisement?

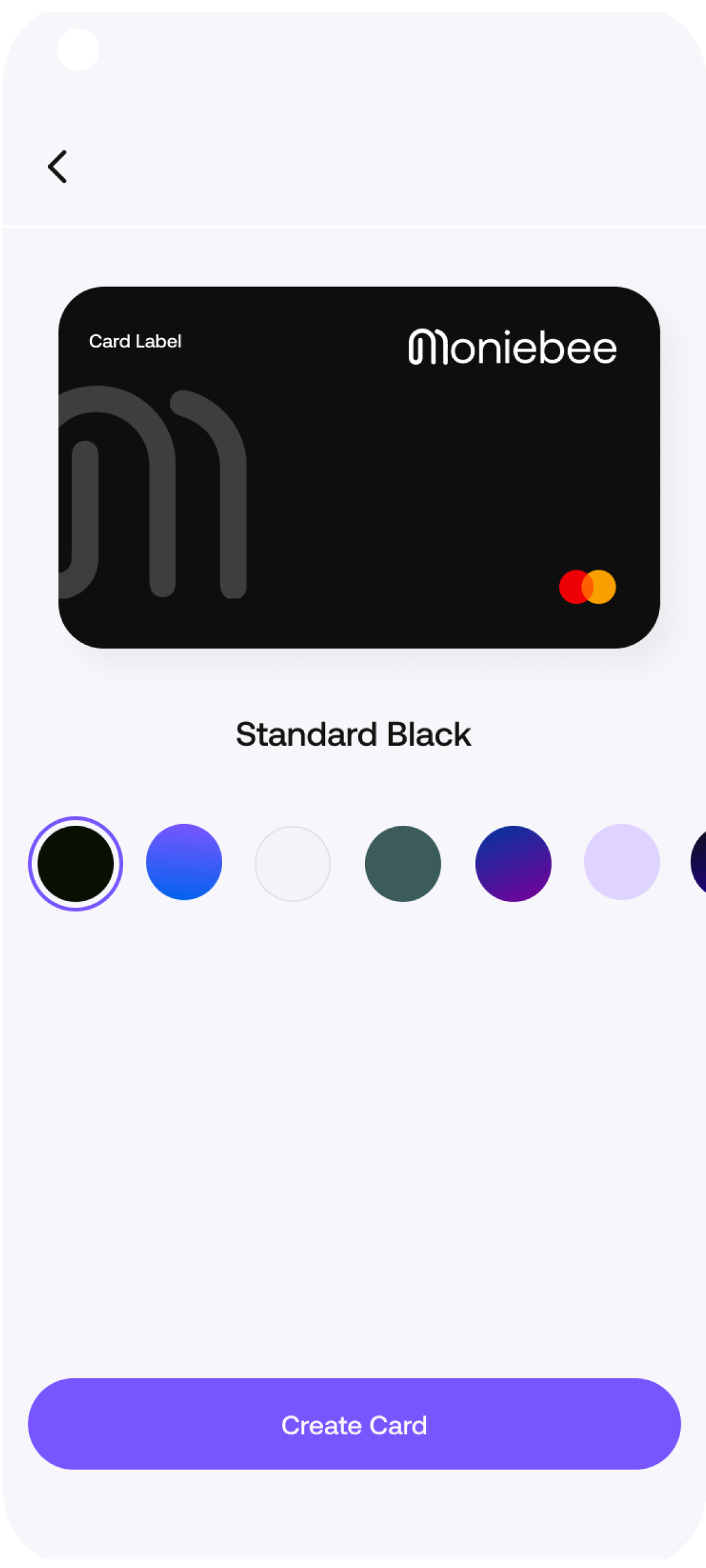

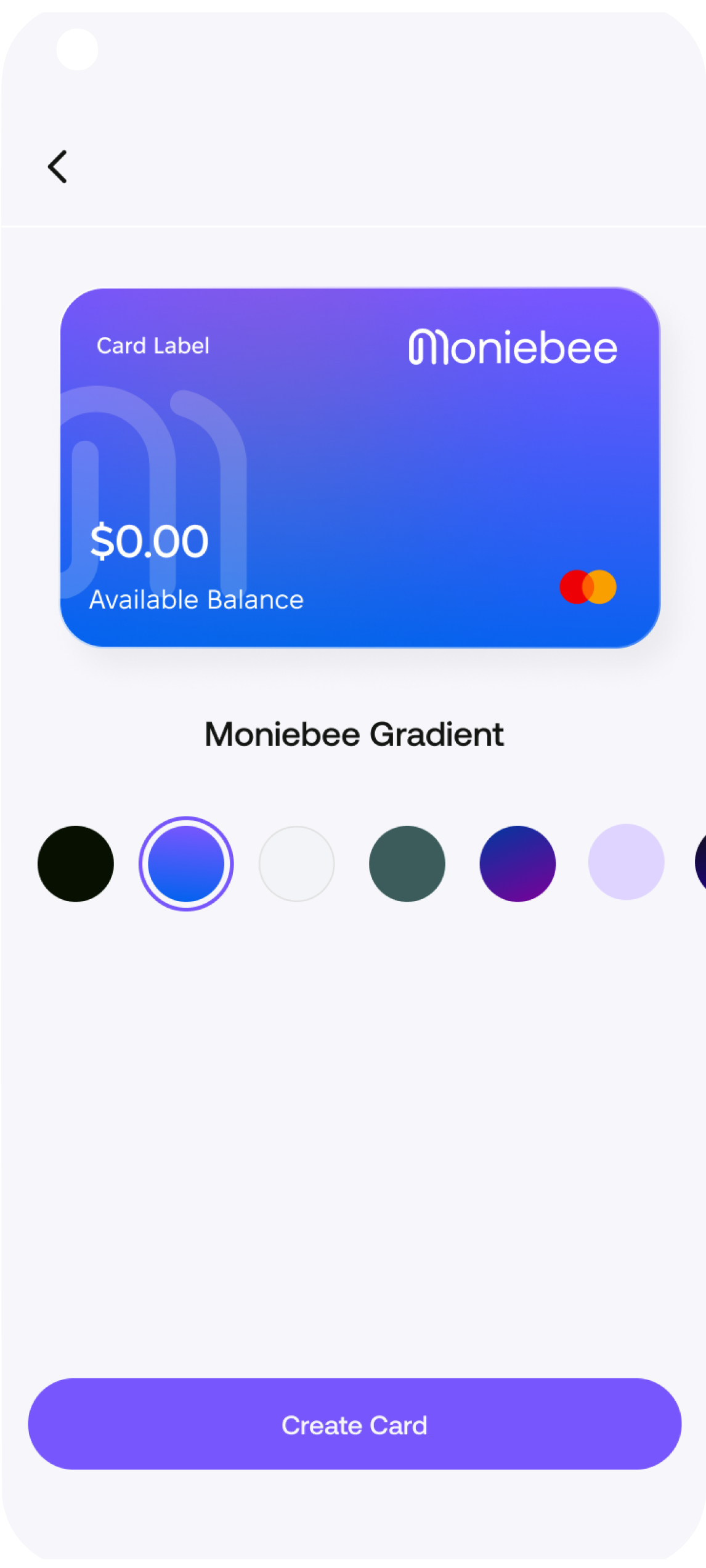

Our business virtual credit card comes with a USD and Naira wallet to plan your digital advertisement budget.

Website domain payment?

A card streamlined just for your business needs; our virtual credit card works just about on any platform.

Do more with Moniebee

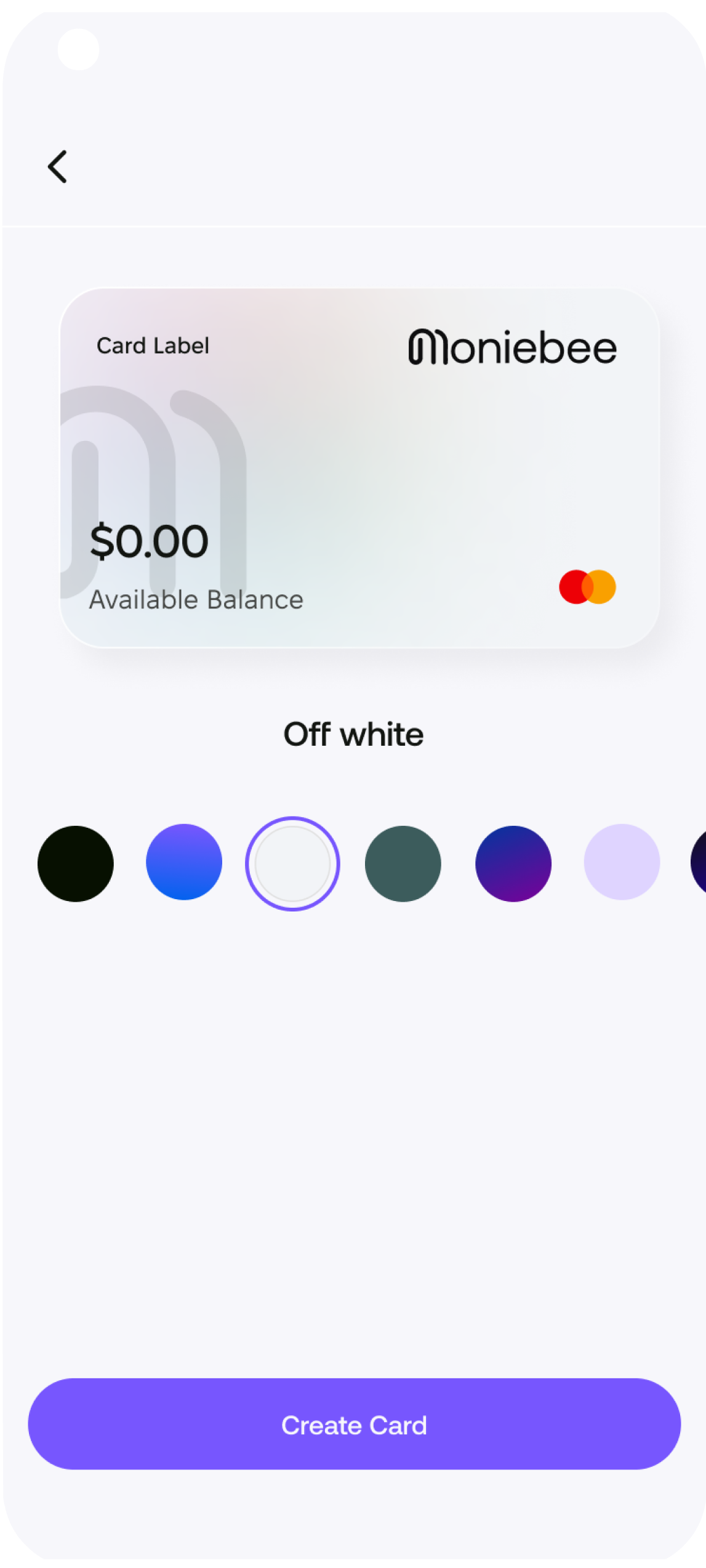

Streamline your online payments: Get a virtual card for your business today.

How Moniebee Virtual Dollar Cards Make Payment Seamless For Business

The mode of payment varies across space and time as people continue to explore better options to make transactions conveniently. This has been at the front burner of many fintechs in this digital age as they are devising scopes and means to attract more users to the online space.

Gone are the days when businesses needed to take checks to the bank to make payment - which was largely characterized by stress and delays. However, the paradigm shift to online payment has revolutionized the financial system such that you can make payments of any amount from the comfort of your home.

Nonetheless, there are certain constraints that you can face when making online payments. One such is sending money across the international border. This is usually difficult to achieve when you intend to transfer funds from one country to another - say, Nigeria to the United States.

While this is not impossible, it can take time and require an exchange rate conversion that may affect the value of the funds. Hence, businesses must adopt a viable way to make cross-border payments with Moniebee.

What Is Moniebee?

Moniebee is a leading fintech company that provides online payment solutions for individuals and businesses. Its services range from money transfers to virtual cards for businesses. You can also use this platform to make bill payments, including airtime, data, and electricity purchases.

Broadly, Moniebee is your one-stop online platform to make payments and transactions that are swift, safe, and seamless.

This platform is currently available in Nigeria, Ghana, and Kenya, on which you can use their respective currencies to make payments for your business.

Meanwhile, we can not overemphasized the relevance of making cross-border payments for businesses that deal with international clients - in terms of products and services.

Today, a Moniebee virtual dollar card gives you the leverage to pay in foreign currencies like the US dollar from anywhere worldwide. It is important to reiterate that the US dollar is considered the global currency. So, a virtual card in this currency can be likened to holding the fiat US dollar.

Using the Moniebee virtual dollar card is easy as you just need to fund your account in US dollars to enjoy its benefits. It also includes a currency swap in which businesses can exchange between naira and dollars to make transactions without any hassle.

Benefits Of Moniebee Virtual Cards for Businesses

While the Moniebees App provides convenience and security, it's crucial to take additional steps to protect your card information when using the app. Here are some reasons why card protection is essential:

Streamline Accounts Payable Process

Protecting your card information reduces the risk of unauthorized access to your financial accounts. By implementing security measures, such as using a strong password, enabling two-factor authentication, and keeping your device and app up to date, you can mitigate the chances of fraudulent activities.Improved Accountability

Businesses do not need to be concerned with mystery payments or contest a receipt of payment when they use a Moniebee virtual card. This is because planned payments or those made already can be categorized, labeled, and organized neatly for accountability.

You can access real-time transactions the card uses as they can not be altered. As such, it helps the reconciliation of your business revenue and expenditure.Better Security

Moniebee virtual card offers improved security than conventional ATM cards. This is because your virtual card can not be stolen, nor can people use the information without your authorization. In addition, you can request the Moniebee virtual card for a one-off payment - meaning that you invalidate the card after a particular use.

Moreover, you are of the volition to freeze, cancel, or delete your Moniebee card in the event of a suspected security breach of your card.Better Spending Control

Businesses can use Moniebee virtual cards to have a good management culture of their funds. This is in relation to expenses such that budgets can be tailored to the funds available on the card. This prevents the business from spending beyond the card’s limit while providing real-time notification on the balance after expenses.Online Advertisement

Businesses can use Moniebee virtual cards to make online advertisements across social media platforms like Facebook, Instagram, Twitter, or YouTube, including search engines like Google. Small and medium-scale businesses can seamlessly advertise their products and services to a larger online audience.

Above all, using the Moniebee virtual card is simple; you must create an account and fund it to start.

You can download the Moniebee app on the Google Play Store to start using the virtual card anywhere you are.

Conclusion

There is no better time for businesses to go digital than now. Your online presence enables you to adopt better strategies for making digital payments. That can only be possible and simple with Moniebee.

Start using a Moniebee virtual card for your business payment.